Tax can be calculated within the total amount or shown as an additional amount to the total.

Tax is not calculated on the donation portion when using the “Donations With feature”.

1. GST

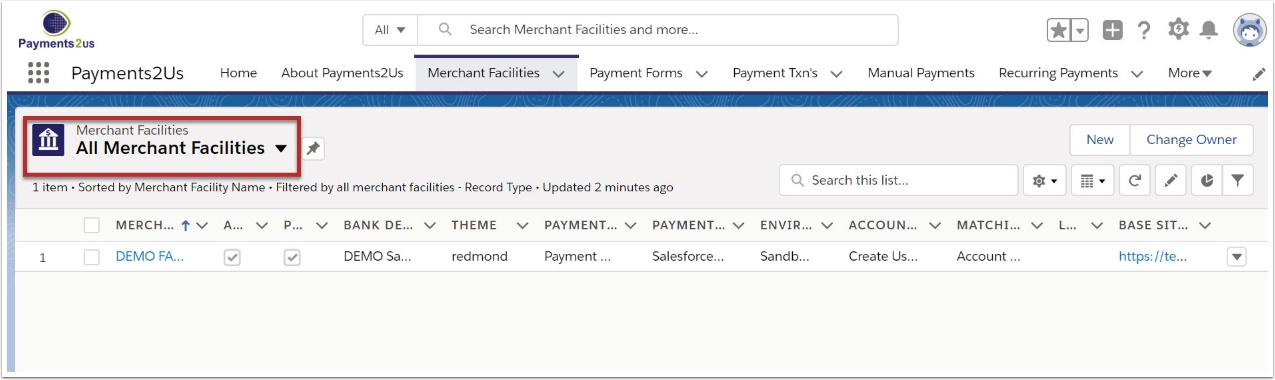

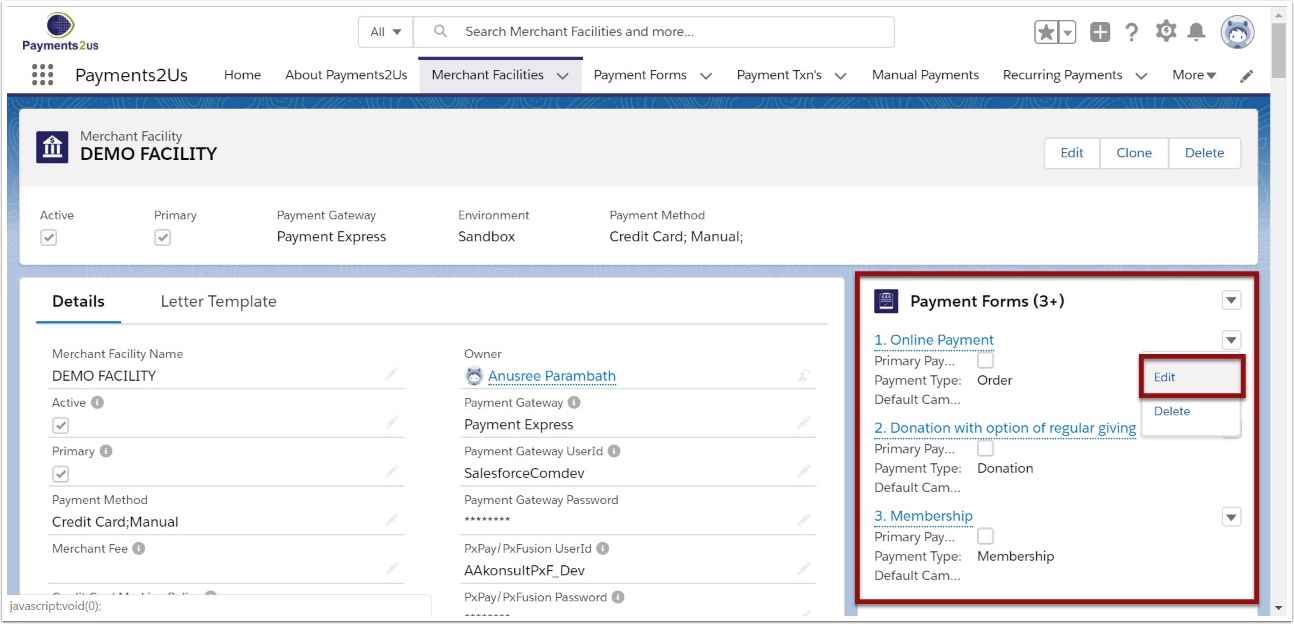

The Merchant Facility tab can be found within the Payments2Us menu (Top right picklist in Salesforce - Select Payments2Us), or it can be found under the "More" at the end of the tabs. (In Salesforce Classic - It can be under the "+" at the end of the tabs)

Once you have clicked on the Merchant Facility Tab, select the appropriate List view (Example - "All Merchant Facilities") and click into Merchant Facility you wish to update.

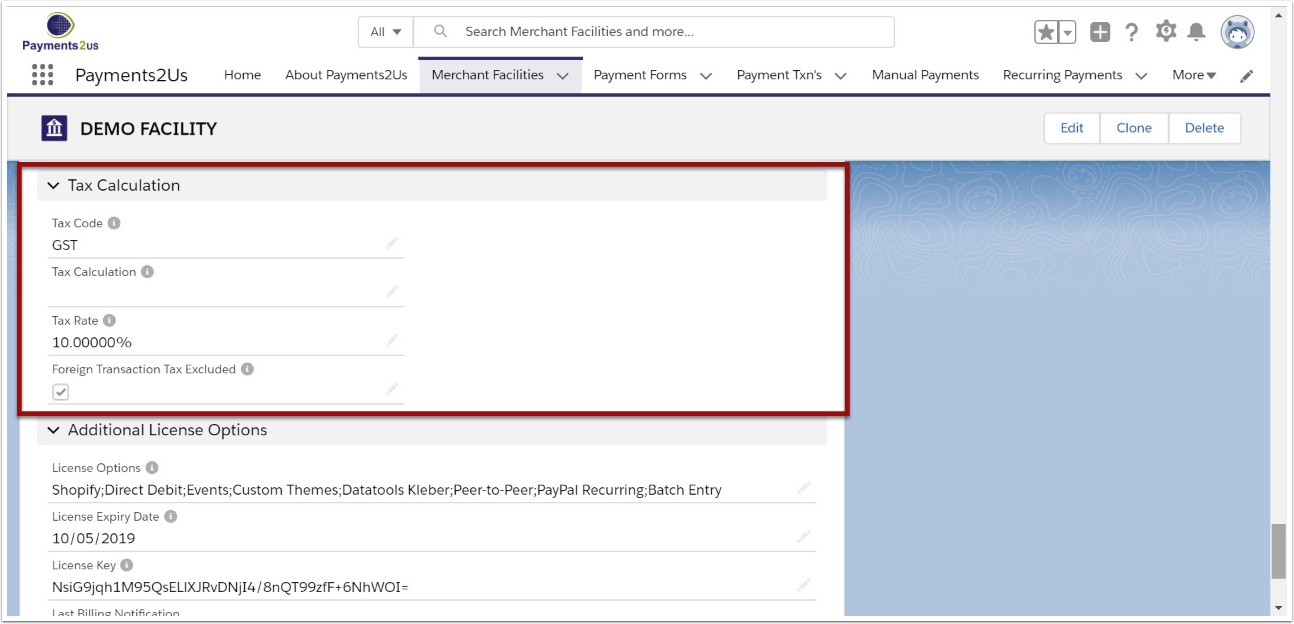

1.2. Scroll down to Tax Calculation heading

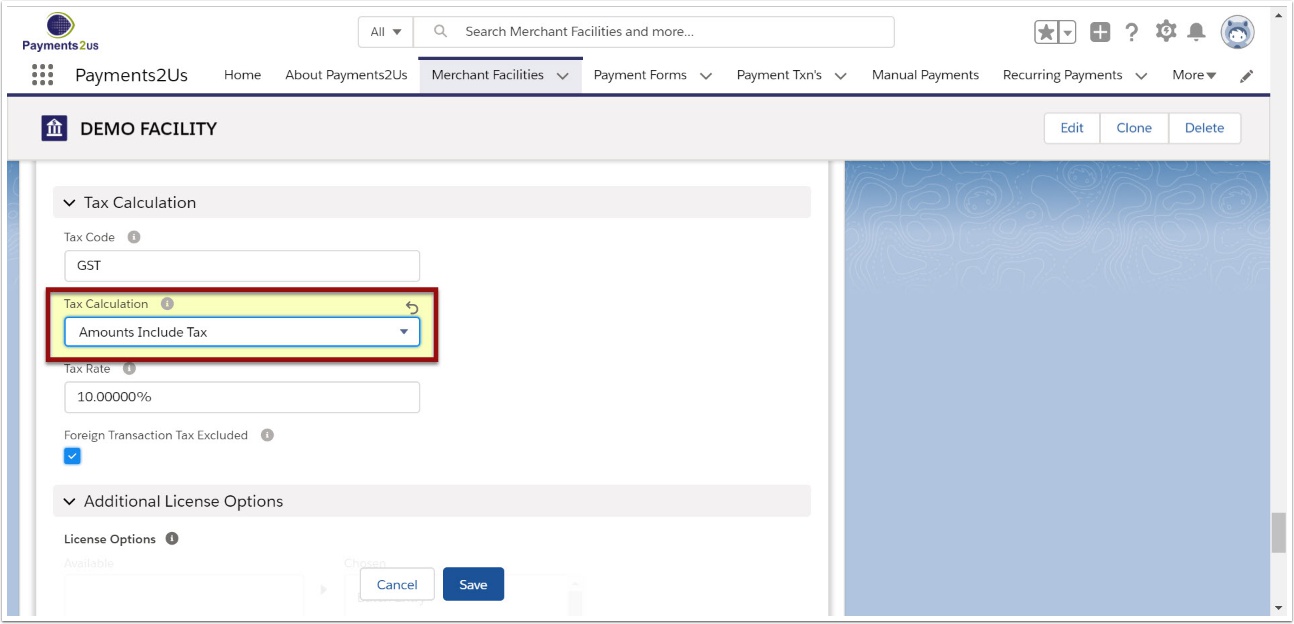

1.3. Set the Tax Calculation field to suit your requirements

- No Tax or blank: This means no tax calculations will occur and the tax field will not appear on the payment checkout form or receipts.

- Amounts Include Tax: The total sale amount includes tax and the tax percentage of this is calculated.

- Amounts Exclude Tax: The amount for the product/service does not include tax and this is to be calculated and added. If surcharges are being used then the surcharge will also be recalculated to include tax amount for the surcharge.

- Tax Amount Specified Inclusive: The amount of tax is passed in via a URL Token, Encrypted URL Parameter or Dynamic URL Parameter. The Tax amount is not calculated and the value provided is used. The Total Amount includes the tax specified.

- Tax Amount Specified Exclusive: The amount of tax is passed in via a URL Token, Encrypted URL Parameter or Dynamic URL Parameter. The Tax amount is not calculated and the value provided is used. The Total Amount excludes the tax specified and therefore tax is added.

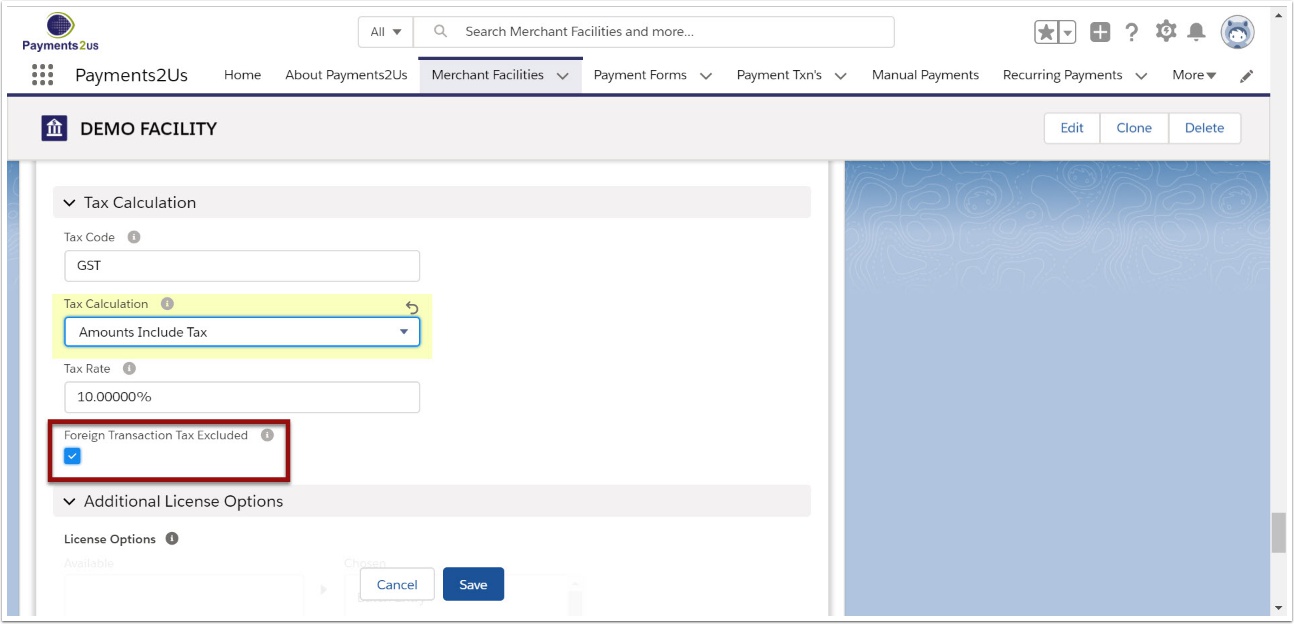

2. Foreign Transactions

2.1. Tick if you would like foreign transactions excluded from tax calculations.

IMPORTANT NOTE: A transaction is considered to be foreign if the country selected does NOT match the "Default Country" specified on the Merchant Facility.

3. Donations

Tax is not calculated on the donation portion when using the “Donations With feature” OR if the Payment Form - Type is set to Donation

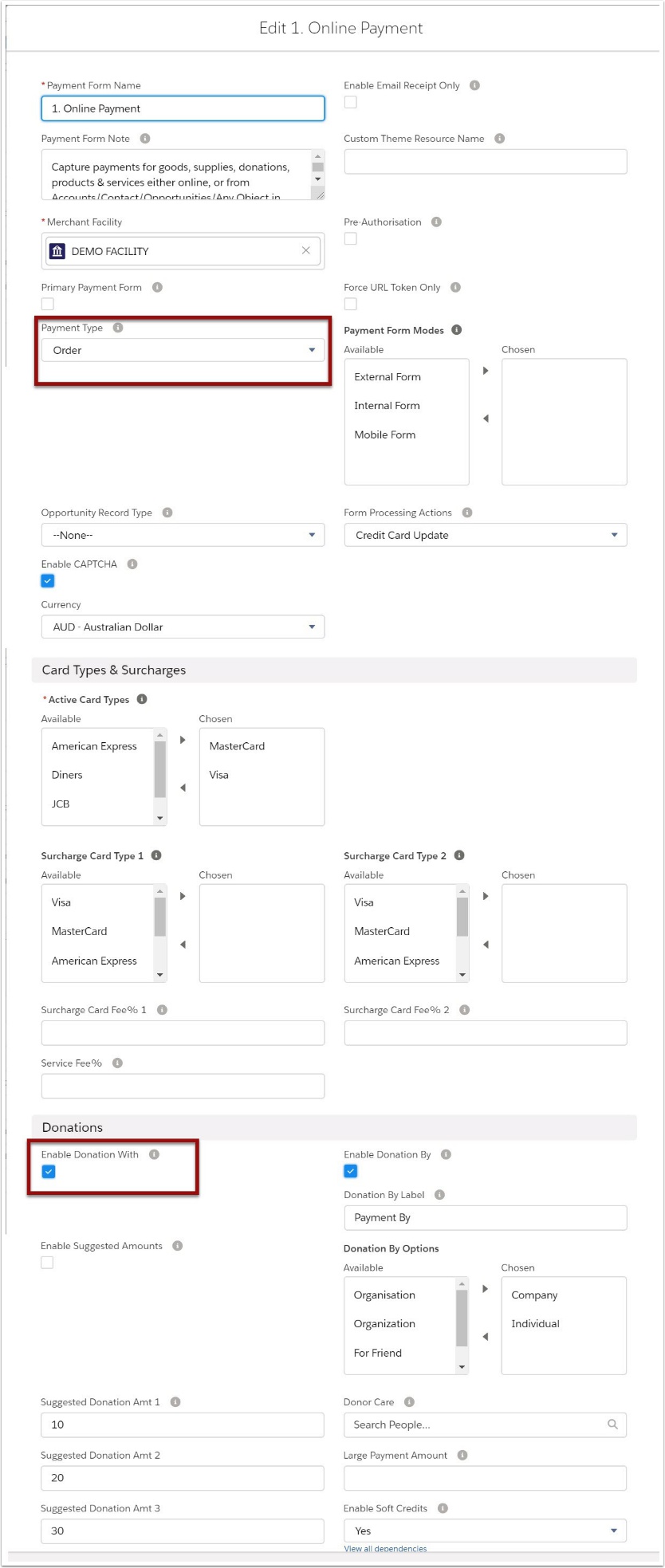

3.1. Select the Payment Forms heading and select 'edit' for the form you wish to modify

3.2. Tick the 'Enable Donation With' checkbox

Tax is not calculated in the Donation with component OR where the Payment Type is set to Donation.